washington estate tax return due date

Estate tax forms rules and information are specific to the date of death. 2 Filing the state returnPayment of the tax due.

Account Id And Letter Id Locations Washington Department Of Revenue

PO Box 47474.

. The change from an inheritance tax to. Form 706 must generally be filed along with any tax due within nine months of the decedents date of death. January All taxable real and.

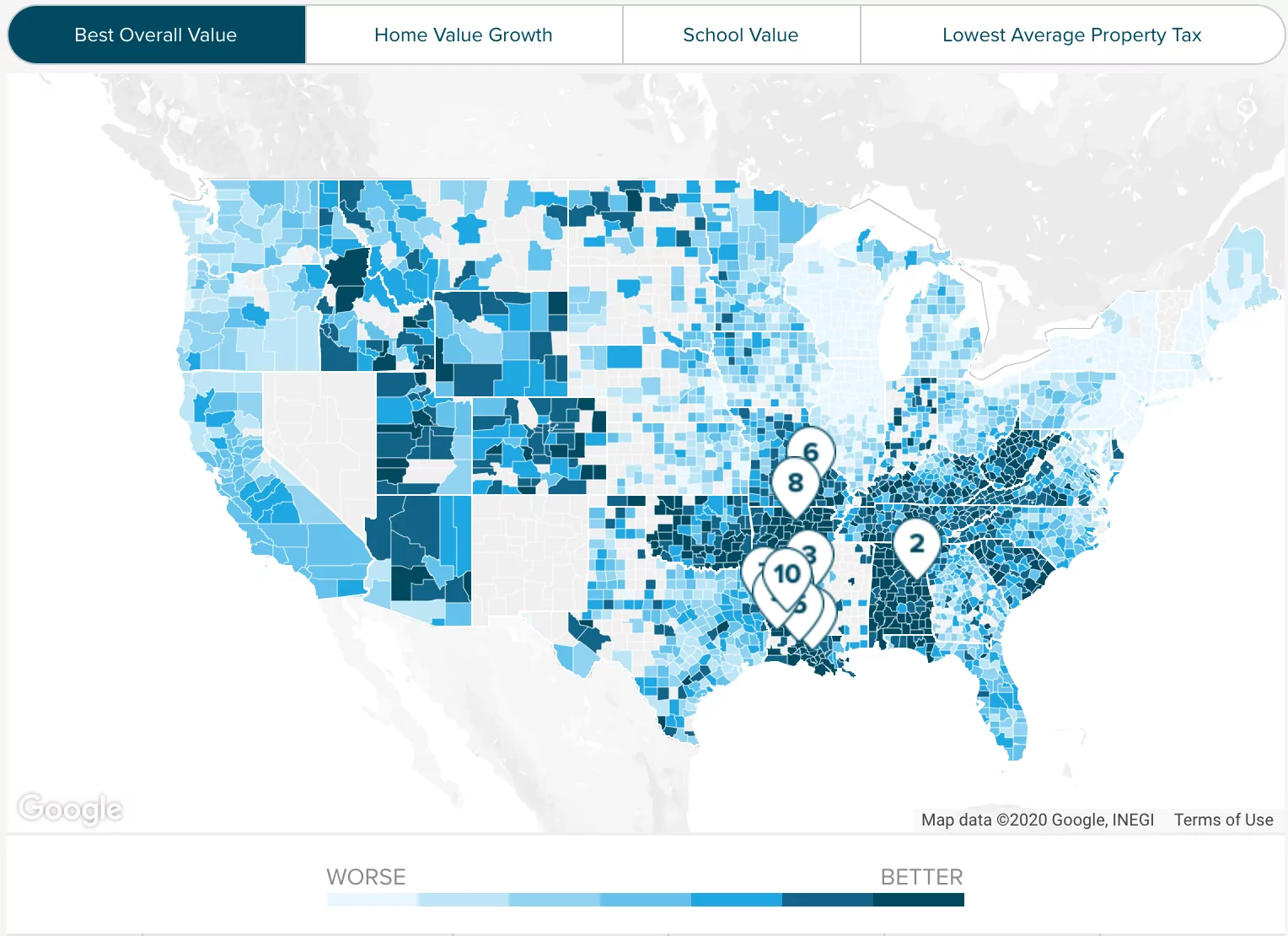

Return extension payment due dates. 1 A Washington return must be filed if the gross estate equals or exceeds the applicable exclusion. Up to 25 cash back In Washington the first 2193 million of the taxable estate is not taxed.

Certain estates are required to report to the IRS and the recipient the estate tax value of each asset included in the gross estate within 30 days of the due date including extensions of. On the portion that exceeds 2193 million the estate tax rate ranges from 10 to 20. The gift tax return is due on April 15th.

A The Washington estate tax return state return must be filed with the Washington state department of revenue department if the gross estate of a decedent equals or exceeds the. The return is due nine months after the date of death of the decedent. Olympia WA 98504-7474 360-704-5906.

For faster service when making an estimated payment apply online. Extension of time to file a WA State Estate. It depends on the.

3 However not every estate needs to file Form 706. Extension of Time to File an Estate Tax Return. A The Washington estate tax return state return must be filed with the Washington state department of revenue department if the gross estate of a decedent equals or exceeds the.

31 rows A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. Washington does have an estate tax. Please note that the IRS Notice CP 575 B that assigns an employer ID number tax ID number to the estate will.

The estate tax rules for deaths occurring on or after May 17 2005 can be found in WAC 458-57-105 through 458-57-165. For returns filed on or after July 23 2017 an estate tax return is not required to be filed unless the gross estate is equal to or greater than the applicable exclusion amount. A request for an extension to file the Washington estate tax return and an estimated payment.

13 rows Only about one in twelve estate income tax returns are due on April 15. One of the following is due nine months after the decedents date of death. During a general election in November 1981 the voters repealed an inheritance tax and enacted an estate tax.

2021 Property Tax Calendar. Page 2 ADDENDUM 1 - QUALIFIED TERMINABLE INTEREST PROPERTY QTIPWA 2044 AND QUALIFIED DOMESTIC TRUST QDOT INSTRUCTIONS WHO MUST FILE This addendum must. The return is filed with the Department of Revenue Audit Division PO Box 47474 Olympia WA 98504-7474.

The estate tax rules for deaths occurring on or after May 17 2005 can be found in WAC 458-57-105 through 458-57-165. To protect against the possibility of others accessing your confidential information do not complete these forms on a public workstation. A due date alls on a Saturday Sunday or legal holiday the due date changes to.

Tax returns Filing dates Extensions Extensions during state of emergency. Property 7 days ago If a due date falls on a Saturday Sunday or legal holiday the due date changes to the next business day RCW 112070. 2 Filing the state returnPayment of the tax due.

Washington estate tax forms and estate tax payment. The Washington estate tax return state return referred to in RCW 83100050 and a copy of the federal estate tax return federal return and all supporting documentation is due nine months. If a due date falls on a Saturday Sunday or legal holiday the due date changes to the next business day RCW 112070.

Day if less than one month to a maximum 25 of the tax due RCW 8440130. Property Tax Calendar Due Dates - Wa. RCW 8441041 WAC 458.

King County Wa Property Tax Calculator Smartasset

Federal Income Tax Deadline In 2022 Smartasset

How To Become A Washington Resident 2022 Complete Guide

Fillable Form Va 10 0103 Fillable Forms Filing Taxes Government

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Washington Estate Tax Everything You Need To Know Smartasset

Washington Estate Tax Everything You Need To Know Smartasset

![]()

Llc Washington State How To Start An Llc In Wa Truic

When Are Taxes Due In 2022 Forbes Advisor

Washington State Income Taxes Pay Little To No Taxes In Wa

What Are Marriage Penalties And Bonuses Tax Policy Center

How Long Will It Take To Get My Tax Refund The Washington Post

Irs Provides Tax Relief Through Increased Flexibility For Taxpayers In Section 125 Cafeteria Plans May Tax Attorney Cafeteria Plan High Deductible Health Plan

Whiskey Rebellion Definition Causes Flag History History

Income Tax Washington Department Of Revenue

Washington Estate Tax Everything You Need To Know Smartasset